Taking Advantage of Homebuying Affordability in Today’s Market

Everyone is ready to buy a home at different times in their lives,

and despite the health crisis, today is no exception. Understanding how

affordability works and the main market factors that impact it may help

those who are ready to buy a home narrow down their optimal window of

time to make a purchase.

There are three main factors that go into determining how affordable homes are for buyers:

- Mortgage Rates

- Mortgage Payments as a Percentage of Income

- Home Prices

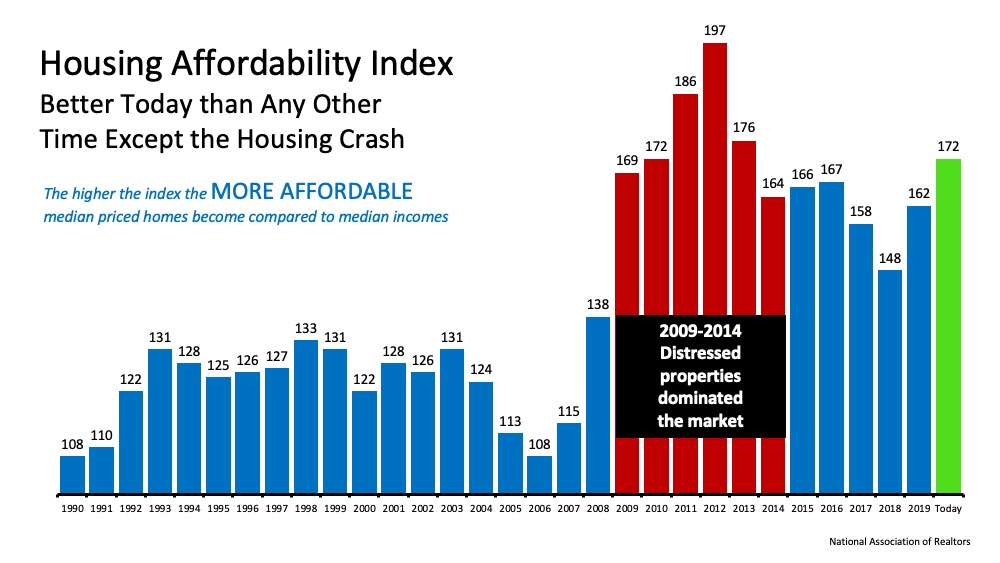

The National Association of Realtors (NAR), produces a Housing Affordability Index,

which takes these three factors into account and determines an overall

affordability score for housing. According to NAR, the index:

“…measures whether

or not a typical family earns enough income to qualify for a mortgage

loan on a typical home at the national and regional levels based on the

most recent price and income data.”

Their methodology states:

“To interpret the

indices, a value of 100 means that a family with the median income has

exactly enough income to qualify for a mortgage on a median-priced home.

An index above 100 signifies that family earning the median income has

more than enough income to qualify for a mortgage loan on a

median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here’s a graph of the index going back to 1990:The

green bar represents today’s affordability. We can see that homes are

more affordable now than they have been at any point since the housing

crash when distressed properties (foreclosures and short sales)

dominated the market. Those properties were sold at large discounts not

seen before in the housing market.

Why are homes so affordable today?

Although there are three factors that drive the overall equation, the

one that’s playing the largest part in today’s homebuying affordability

is historically low mortgage rates. Based on this primary factor, we can see that it is more affordable to buy a home today than at any time in the last seven years.

If you’re considering purchasing your first home or moving up to the

one you’ve always hoped for, it’s important to understand how

affordability plays into the overall cost of your home. With that in

mind, buying while mortgage rates are as low as they are now may save

you quite a bit of money over the life of your home loan.

Bottom Line

If you feel ready to buy, purchasing a home this season may save you

significantly over time based on historic affordability trends. Let’s

connect today to determine if now is the right time for you to make your

move.